In today’s fast-moving digital economy, fintech startups are handling more sensitive customer data than ever before—credit card details, banking credentials, and personal identifiers that demand rock-solid protection. But with innovation comes responsibility. As you scale your product, regulatory compliance isn’t just a box to tick—it’s a competitive advantage and a trust signal.

Failing to meet PCI DSS compliance or SOC 2 for fintech standards can have severe consequences: costly data breaches, regulatory penalties, and long-term damage to customer trust. A 2024 IBM report found that the average cost of a data breach in the financial sector reached $5.9 million, one of the highest across industries.

And it’s not just about fines—88% of customers say they won’t do business with a company they don’t trust to handle their data responsibly (PwC Consumer Intelligence Series).

That’s why we created this guide. Whether you’re building a payment platform, lending app, or digital wallet, this post will walk you through the essential security and compliance frameworks—PCI DSS, SOC 2, and beyond.

In plain English, you’ll learn how to implement strong data protection practices, how to become SOC 2 compliant step-by-step, pass audits, and go to market confidently without compromising on fintech data security.

Let’s break down what it really takes to build a secure and compliant fintech product from day one.

Key Takeaways: Secure & Compliant Fintech Infrastructure

- Security and compliance are critical from day one in fintech—essential for user trust, investor confidence, and regulatory approval.

- Understand and implement key frameworks:

- PCI DSS for handling cardholder data

- SOC 2 for data security and enterprise credibility

- ISO 27001 for global scalability and ISMS governance

- Build secure infrastructure with:

- AES-256 encryption, TLS 1.2+, and SHA-256 hashing

- Role-Based Access Control (RBAC) and session management

- Secure DevOps pipelines with CI/CD and code scanning

- Implement real-time monitoring using:

- SIEM tools (e.g., Datadog, Splunk)

- Anomaly detection and fraud scoring

- Custom logic like velocity checks and duplicate pattern detection

- Maintain robust audit trails by logging:

- User activity, transaction metadata, admin access

- Logs stored securely with proper retention policies

- Use DevSecOps practices to embed security into your development lifecycle and reduce last-minute compliance chaos

- Leverage compliance accelerators like Vanta, Drata, or Strike Graph to speed up SOC 2 and PCI DSS readiness

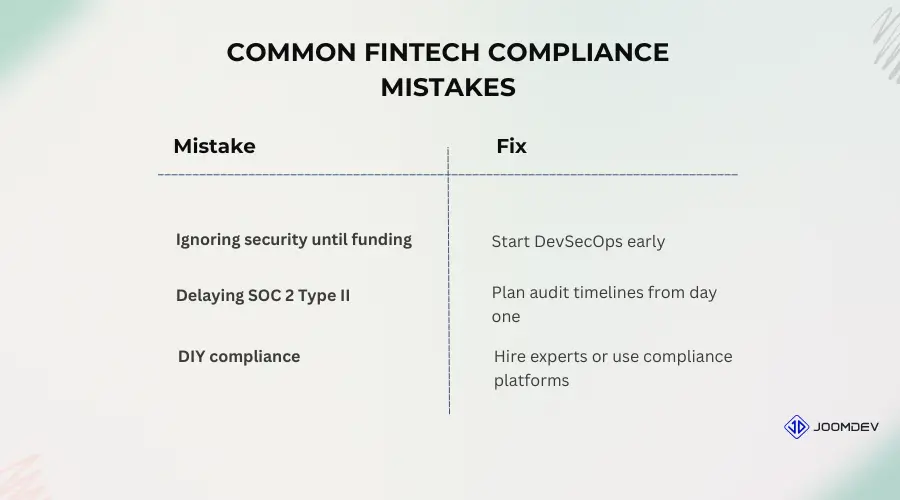

- Avoid common mistakes:

- Ignoring security until funding

- Delaying SOC 2 Type II

- Attempting DIY compliance without expert help

- Partner with a compliance-savvy development team to launch fast, stay secure, and scale confidently

Why Security and Compliance Are Non-Negotiable in Fintech

Fintech is built on trust—and trust is built on security.

When you’re dealing with sensitive financial data and real-time transactions, security and compliance aren’t “nice to have”—they’re fundamental to survival and growth.

Here’s why security and compliance aren’t optional:

Regulatory Enforcement is Global and Growing

Governments and regulators worldwide are intensifying scrutiny on fintech security. In the U.S., companies handling credit card transactions must comply with PCI DSS standards, while cloud-based fintech platforms must demonstrate SOC 2 Type II compliance to meet partner and enterprise security requirements.

In Europe, the GDPR framework imposes strict rules around data protection and user consent. Violations can result in fines up to €20 million or 4% of annual global turnover—whichever is higher.

Compliance Builds Credibility With Investors and Partners

Fintech startups looking to scale or raise venture capital must prove their operational readiness, and security is a major part of that equation. Many VCs now look for SOC 2 readiness as a de facto requirement before investing.

Bessemer Venture Partners notes that “SOC 2 compliance signals that a startup takes infrastructure maturity and data handling seriously,” making it easier to close B2B deals and enterprise partnerships

Useful Read: 7 Data Security Practices For Fintech Companies

Fintechs Are Prime Targets for Cyberattacks

The financial services sector is consistently among the most targeted by cybercriminals, with a heavy focus on fintech startups due to their rapid growth and often underdeveloped security posture.

A 2023 Salesforce survey found that 63% of customers would stop buying from companies that fail to protect their data

Non-Compliance Has Legal and Financial Fallout

From penalties and lawsuits to reputational loss and customer churn, the costs of ignoring compliance are too high to ignore. Fintechs that fail audits or breach regulatory frameworks face delayed product launches, restricted partnerships, and loss of market access.

If you’re building or scaling a digital finance product, don’t miss our post on Fintech App Development: A Step-by-Step Guide for Founders where we cover everything from architecture to compliance-ready development best practices.

Compliance Frameworks Every Fintech Startup Must Understand

Fintech founders often ask, “Do I really need all these certifications?” The short answer: yes — if you want to win trust, scale globally, and reduce risk.

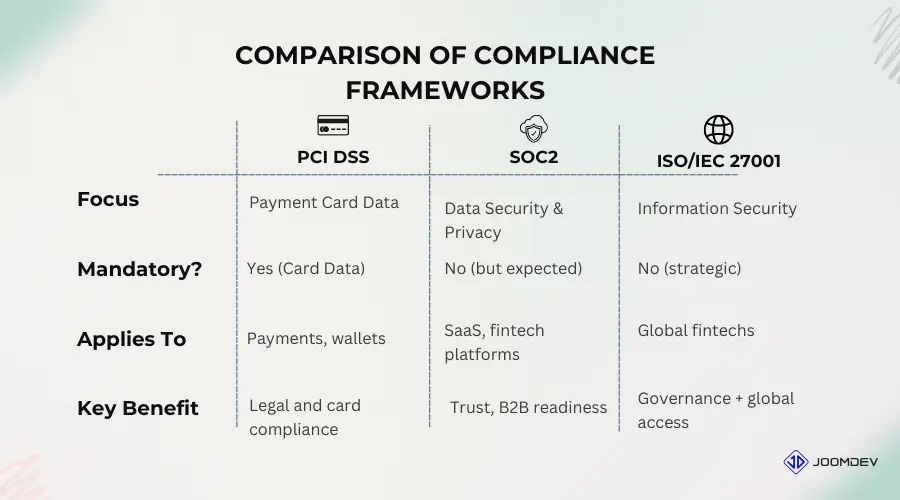

Here’s a simplified breakdown of the three most critical frameworks—PCI DSS, SOC 2, and ISO 27001—what they mean, who needs them, and how they impact your growth trajectory.

PCI DSS – Payment Card Industry Data Security Standard

If your fintech product handles, stores, or transmits credit card data, PCI DSS compliance is mandatory.

Who Needs PCI DSS?

- Payment processors

- Digital wallets

- BNPL (Buy Now Pay Later) platforms

- Any product handling cardholder data (even if via third-party APIs)

The 12 Core Requirements (Simplified):

- Install and maintain a firewall

- Avoid using default system passwords

- Protect stored cardholder data

- Encrypt transmission of data across networks

- Use antivirus software

- Maintain secure systems and apps

- Restrict access by business need-to-know

- Assign unique IDs to users with access

- Restrict physical access to cardholder data

- Track and monitor all access

- Regularly test security systems

- Maintain a policy that addresses information security

Tip: Even if you use Stripe or another PCI-compliant provider, your app still shares responsibility. Always check your PCI SAQ (Self-Assessment Questionnaire) category.

SOC 2 – Service Organization Control 2

SOC 2 is not a legal requirement but has become the gold standard for fintechs handling sensitive data and working with enterprise clients.

Trust Services Criteria:

- Security (required)

- Availability

- Confidentiality

- Processing Integrity

- Privacy

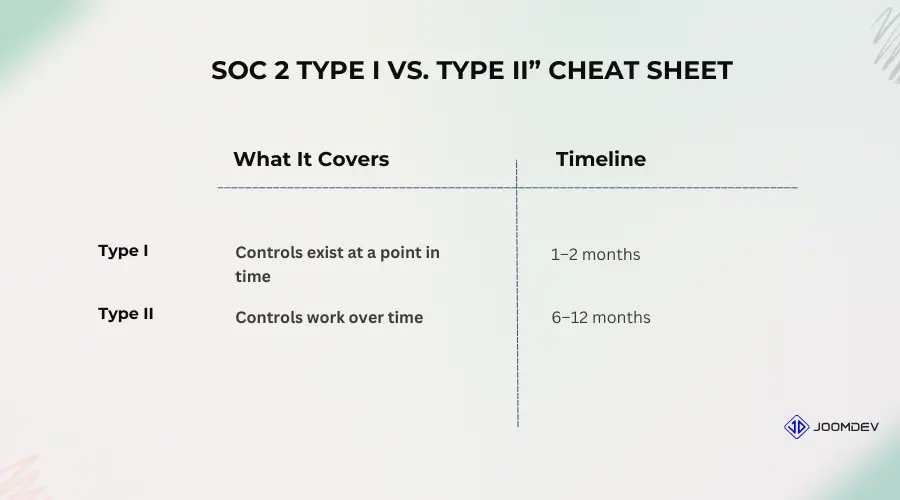

SOC 2 Type I vs Type II

| Type | What It Covers | Timeline |

|---|---|---|

| Type I | Controls exist at a point in time | 1–2 months |

| Type II | Controls work effectively over time (3–12 months) | 6+ months |

SOC 2 audits help you prove that your systems are secure, monitored, and well-governed—a must for partnerships with banks, payment networks, or large fintechs.

According to Bessemer Venture Partners, SOC 2 Type II is a “non-negotiable” for fintechs serving B2B or enterprise.

ISO 27001 – The Global Standard for Information Security

ISO 27001 is a globally recognized framework for building, maintaining, and continuously improving your Information Security Management System (ISMS).

Why It Matters for Fintech:

- Opens doors to international expansion

- Aligns with GDPR, SOC 2, and other privacy regulations

- Ideal for scaling companies preparing to work with cross-border partners

ISO 27001 certification is highly valued by European partners, global banks, and multinational vendors. It demonstrates maturity, risk management, and commitment to continuous improvement.

Summary Table: Which Compliance Framework Is Right for You?

| Framework | Mandatory? | Applies To | Key Benefit |

|---|---|---|---|

| PCI DSS | Yes (if handling cards) | Payments, wallets | Meets legal & card network requirements |

| SOC 2 | No (but expected) | SaaS, fintech platforms | Builds trust, wins partners |

| ISO 27001 | No (but strategic) | Global or scaling startups | International readiness, ISMS governance |

Pro Tip: Many fintechs aim to align their infrastructure with PCI DSS + SOC 2 Type I early on and pursue SOC 2 Type II or ISO 27001 as they mature.

Building a Secure Infrastructure for Fintech Applications

Security isn’t a single feature—it’s a culture, a mindset, and a set of practices that start with your architecture and codebase. At JoomDev, we help fintech startups design and implement infrastructure that’s not only scalable, but secure and audit-ready from day one.

Here’s how we approach core components of a secure fintech stack:

Data Security & Encryption Practices

Fintech apps process high-value, high-risk information—user credentials, account balances, transactions, and personally identifiable information (PII). That makes data encryption in fintech one of the most critical pillars of your infrastructure.

Key Techniques We Implement:

- AES-256 Encryption: The industry gold standard for encrypting data at rest. Used by banks, governments, and cloud platforms alike.

- TLS 1.2+ for Data in Transit: We enforce HTTPS with strong ciphers to ensure data moving between servers and clients remains private.

- SHA-256 Hashing: Applied for sensitive comparisons like passwords and API keys, ensuring that even if data is compromised, it’s not reversible.

- Tokenization vs. Encryption: We help our clients choose the right approach depending on compliance needs. Tokenization replaces data with non-sensitive placeholders, perfect for minimizing PCI DSS scope.

- Secure Key Management: We implement role-based secrets rotation policies and leverage AWS KMS, HashiCorp Vault, or GCP Secret Manager to prevent key leakage or exposure in code.

According to Thales Group’s 2023 Data Threat Report, 45% of financial institutions reported a data breach in the past year, with inadequate encryption cited as a major factor. (source)

Access Control & User Role Management

Even the best encryption can’t save you from mismanaged access controls. We help fintech teams implement robust policies that follow the principle of least privilege—users and systems only get access to what they absolutely need.

Our Access Strategy Includes:

- Role-Based Access Control (RBAC): Define granular roles for customers, support agents, developers, auditors, and super-admins. This ensures clear boundaries and prevents lateral privilege escalation.

- Session Management: Timeouts, IP validation, user agent locking, and device-level fingerprinting to detect session hijacking or reuse.

- Multi-Factor Authentication (MFA): Integrated for both internal admin portals and high-risk user actions (e.g., bank transfers or password changes).

- Audit-Ready Admin Access Logs: Every admin action—login, data export, role changes—is logged with timestamp, IP, and user identity.

Fun Fact: Google’s zero-trust model emphasizes “verify explicitly”—even internal services should assume they’re communicating over an untrusted network.

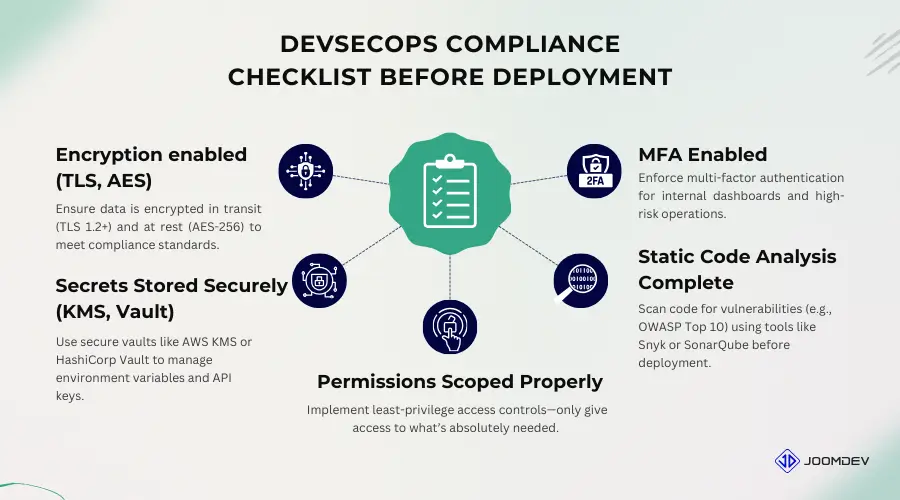

Secure Coding & DevOps Practices

Security doesn’t stop at design—it continues through development, deployment, and updates. We work with fintech clients to bake security into every phase of the Software Development Lifecycle (SDLC).

DevSecOps Essentials We Follow:

- Secure Coding Guidelines: We train teams on the OWASP Top 10 vulnerabilities—like SQL injection, XSS, and insecure deserialization.

- Code Reviews & Static Analysis: Peer-reviewed pull requests plus automated scanning using tools like SonarQube, Snyk, and GitHub Advanced Security.

- Penetration Testing: Regular white-hat audits with third-party security testers to simulate real-world attacks.

- Infrastructure-as-Code (IaC) with Compliance Checks: Terraform or AWS CloudFormation templates pre-audited for security misconfigurations.

- Deployment Checklists: Each release is gated with a checklist that includes:

- Encryption enabled?

- Secrets stored securely?

- Logging configured?

- Permissions scoped properly?

According to Verizon’s 2023 Data Breach Investigations Report, 74% of breaches involve the human element—social engineering, misuse, or simple errors. DevSecOps helps reduce these by catching issues before they reach production.

By combining encryption, access control, and secure development, you build not only a safer product—but also a more fundable, partner-friendly, and scalable fintech business. This foundation is what lets you pursue PCI DSS and SOC 2 certifications with confidence.

Real-Time Monitoring and Fraud Detection in Fintech

In a world of instant payments, real-time fraud detection isn’t optional—it’s your last line of defense. Fintech platforms process thousands of transactions every minute, which makes them a prime target for account takeovers, synthetic identity fraud, and transaction laundering.

To stay ahead of these threats, we help startups build real-time monitoring systems that combine advanced tooling with custom business logic tailored to your specific risk profile.

Core Tools for Real-Time Threat Detection

We integrate with best-in-class tools to help you monitor, alert, and respond to suspicious behavior before it escalates into fraud or a breach.

Security Information & Event Management (SIEM)

SIEM platforms like Splunk, Datadog Security, and Elastic SIEM aggregate logs from your infrastructure, applications, and user actions to provide a centralized, real-time view of security events.

- Detect unusual login locations

- Alert on failed login spikes

- Correlate events across systems (e.g., login + fund transfer anomalies)

Anomaly Detection Engines

Machine learning models—either in-house or via tools like AWS GuardDuty, Azure Sentinel, or Sift Science—can flag out-of-pattern behaviors such as:

- Unusually large withdrawals

- Access during odd hours

- First-time user performing high-risk actions

Third-Party Fraud Prevention APIs

We often recommend solutions like Stripe Radar, Sardine.ai, or Arkose Labs to add pre-trained fraud prevention layers—especially useful for payment fintechs.

Custom Business Logic: Your Secret Weapon

While external tools are powerful, custom fraud logic often gives you the best results—because it’s tailored to your users, product, and workflows.

Common Techniques We Use:

- Velocity Checks: Flag users making too many requests or transactions in a short window.

- Duplicate Pattern Detection: Identify repeating transaction fingerprints, common with bots or scripts.

- IP Risk Scoring: Combine IP reputation with geolocation and device fingerprinting.

- Transaction Behavior Scoring: Create weighted scoring models based on:

- Account age

- Frequency of login

- Transaction amount vs average

- Device type + user agent

Example: A new user tries to send $5,000 within 5 minutes of account creation, from a flagged IP using Tor. Your monitoring logic assigns this activity a fraud score >90 and triggers a real-time block with an alert sent to the security team.

Fraud prevention isn’t just about protecting revenue—it’s a core part of PCI DSS and SOC 2 compliance.

- PCI DSS Requirement 10 mandates logging and monitoring of all user activity.

- SOC 2’s Security and Availability criteria require alerting mechanisms and incident response processes.

A delay in detection can also lead to reporting violations under GDPR or CCPA, especially if user data is compromised and authorities aren’t notified within the legally mandated time.

Audit Trails & Logging Systems for Compliance and Accountability

In fintech, if it’s not logged—it didn’t happen.

Robust audit trails aren’t just a nice-to-have for debugging—they’re a core requirement for regulatory audits, incident investigations, and compliance certifications like PCI DSS, SOC 2, and ISO 27001. These logs form the paper trail that proves your platform operates securely and transparently.

Why Audit Logging is a Compliance Essential

Regulators expect you to maintain detailed, immutable records of sensitive activity. Whether you’re undergoing a PCI DSS review or preparing for a SOC 2 Type II audit, proper logging demonstrates that your systems are:

- Secure by design

- Monitored consistently

- Capable of producing evidence in case of a breach

PCI DSS Requirement 10 and SOC 2 Security Criteria both mandate centralized, tamper-proof logs for access, configuration changes, and sensitive user actions.

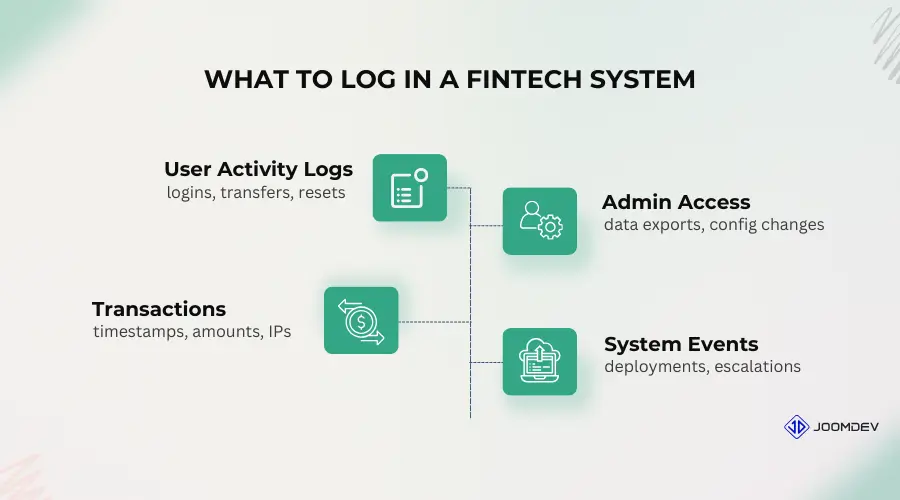

What Should You Log in to a Fintech System?

Not everything needs to be logged—but the right events do. We help fintechs define a logging policy that balances performance, storage, and compliance.

Here’s what we recommend logging:

- User Activity Logs:

- Logins, failed logins, password resets

- High-risk actions (e.g., fund transfers, account linking)

- Access Logs:

- Admin portal usage

- API access by developers or third-party systems

- Transaction Metadata:

- Timestamp, amount, currency, user ID

- Source/destination of funds (wallets, banks, cards)

- Device ID, IP address, location, and risk score (if applicable)

- System Events:

- Configuration changes

- Service restarts, deployments

- Permission escalations or revoked access

Tip: Use structured logging (e.g., JSON format) to make log parsing and querying more efficient.

Retention Policies: How Long Should You Store Logs?

Log retention requirements vary by standard:

| Framework | Minimum Retention |

|---|---|

| PCI DSS | 1 year (3 months accessible) |

| SOC 2 | 12–24 months recommended |

| GDPR | Only as long as necessary for the purpose |

| CCPA | Should align with your privacy policy |

We recommend configuring tiered storage:

- Hot storage for logs from the last 90 days

- Cold storage (e.g., AWS Glacier) for logs up to 2+ years

Tools and Frameworks for Fintech Logging

We use a combination of open-source and cloud-native solutions to implement high-performance, scalable logging systems.

Popular Tools:

- ELK Stack (Elasticsearch, Logstash, Kibana): Ideal for search, visualization, and custom dashboards

- AWS CloudTrail + CloudWatch Logs: Perfect for AWS-native infrastructures

- Datadog: Unified observability and logging with alerting

- Fluentd / Vector: Lightweight log shippers for containerized environments

All logging systems we design include log integrity checks, access controls, and read-only archives to ensure tamper-proof storage.

Audit trails give you the confidence to say:

???? “Yes, we know exactly what happened, when, and why.”

Whether you’re preparing for a compliance audit, conducting an internal investigation, or debugging a suspicious incident—audit logs are your source of truth.

Go-to-Market Fast Without Compromising Security

For early-stage fintechs, speed is everything. Whether you’re racing toward MVP launch or onboarding your first banking partner, there’s immense pressure to move fast.

But here’s the challenge: Compliance and security often feel like roadblocks. Documentation, audits, code reviews, and access policies take time—and time feels like a luxury most founders don’t have.

The good news? You can accelerate time-to-market without sacrificing compliance or putting customer data at risk.

Adopt a DevSecOps Mindset from Day One

Traditional DevOps prioritizes speed. DevSecOps bakes security into every step of development. It’s a cultural and technical shift that allows security to scale with your code, not slow it down.

Here’s how we implement DevSecOps for fintech teams:

- Security as Code: Use automated infrastructure tools (e.g., Terraform, Pulumi) that integrate access control, encryption, and logging by default.

- CI/CD with Security Gates: Tools like Snyk, GitHub Advanced Security, and Checkov catch vulnerabilities before they reach production.

- Automated Compliance Checklists: Each deployment must pass checks on logging, MFA enforcement, permission scopes, and encrypted secrets.

A 2022 study by GitLab found that 56% of DevOps teams that embedded security into their pipelines saw faster release cycles and fewer production bugs.

Use Compliance Accelerators to Skip the Guesswork

You don’t need to reinvent the wheel. Several platforms now offer “compliance as a service”—giving you dashboards, policies, and automation tools that drastically reduce audit preparation time.

Popular Compliance Accelerators:

- Vanta: Automates SOC 2 readiness with policy templates and continuous monitoring

- Drata: Integrates with your codebase, HR, and cloud infra for automated evidence collection

- Strike Graph: Startup-friendly audit prep for SOC 2, ISO 27001, HIPAA

These platforms cut SOC 2 prep time by up to 80%, according to user testimonials. If your fintech needs to demonstrate readiness fast, these tools are worth the investment.

Pro tip: Combine a compliance platform with a security-aware dev team—that’s where the magic happens.

Work with a Compliance-Ready Development Partner

At JoomDev, we’ve helped fintech startups build systems that are PCI DSS scoped, SOC 2 audit-ready, and ISO 27001 aligned—without compromising launch timelines.

Here’s what sets us apart:

- Security-first architecture: We don’t just ship code—we design infrastructure that auditors will love.

- Compliance-savvy workflows: From audit trail implementation to log retention, we handle the details.

- Industry experience: We’ve built solutions for wallet providers, issuing platforms, and lending fintechs with sensitive data requirements.

Want to launch fast and sleep well at night?

Let’s work together to create a solution that redefines financial services.

At JoomDev, we’ve helped fintech startups build systems that are PCI DSS scoped, SOC 2 audit-ready, and ISO 27001 aligned—without compromising launch timelines.Let’s talk about your fintech security roadmap

Fintech Compliance Mistakes (And How to Avoid Them)

Even the most innovative fintech founders make compliance missteps—not because they don’t care about security, but because they’re juggling product, growth, and investor expectations all at once.

Unfortunately, compliance mistakes can delay audits, stall enterprise deals, or worse—lead to data breaches that damage brand trust.

Here are the most common fintech security mistakes we see, and how you can avoid them:

Ignoring Security Until You’ve Raised Funding

Mistake: “We’ll fix security after our seed round.”

Security is often deprioritized in favor of speed, especially during MVP development. But by the time you’re talking to VCs or enterprise partners, they’ll expect you to have clear security policies and architecture in place.

According to Bessemer Venture Partners, startups without basic security practices (like access control, encryption, and incident response plans) face longer due diligence cycles and higher legal scrutiny. (source)

Solution:

Adopt a security-first mindset from day one. Use basic tools like:

- Secure CI/CD with secrets scanning

- MFA for all internal tools

- Logging + access control from the start

Delaying SOC 2 Type II Until You “Need It”

Mistake: “Let’s just do Type I and worry about Type II next year.”

SOC 2 Type I proves you have the controls. SOC 2 Type II proves they work over time—and that’s what enterprise customers and banking partners actually care about.

Delaying it can cost you valuable partnership deals and slow your go-to-market plan.

Solution:

Start SOC 2 Type I early, but build toward Type II continuously. Tools like Vanta, Drata, and Tugboat Logic can automate evidence collection and help you move faster without increasing overhead.

We helped a payments startup complete both audits in under 6 months by embedding automated checks into their deployment process. Ask us how.

Trying to DIY Compliance Without Expert Guidance

Mistake: “We’ll figure out SOC 2 / PCI DSS on our own.”

It’s tempting to Google your way through compliance—until you’re in an audit interview explaining why user access logs were missing or encryption keys weren’t rotated.

DIY compliance leads to:

- Incomplete policies

- Poor documentation

- Gaps that auditors will flag

Solution:

Work with a compliance-experienced dev partner (like JoomDev ????) or a fractional CISO. An experienced team knows how to:

- Scope your systems properly

- Configure infrastructure securely

- Prepare documentation that aligns with audit frameworks

Remember: Compliance isn’t a one-time project. It’s a process—and the earlier you start it, the smoother it becomes.

Fintech Security & Compliance FAQs

Do I need both PCI DSS and SOC 2?

It depends on your product. If you’re handling credit card data, PCI DSS is mandatory. SOC 2, on the other hand, is not legally required but strongly recommended—especially if you’re selling to enterprise clients or managing sensitive user data. Most serious fintechs pursue both as they scale.

How long does SOC 2 Type II take?

SOC 2 Type II typically takes 3 to 12 months, depending on your system complexity and audit readiness. The key difference from Type I is the observation period—you must demonstrate consistent control performance over time. Using platforms like Vanta or Drata can accelerate the timeline significantly.

What’s the difference between SOC 1 and SOC 2?

– SOC 1 focuses on financial reporting controls, usually for companies impacting clients’ financial statements (e.g., payroll processors).

– SOC 2 is all about security, availability, and privacy, and is most relevant to SaaS and fintech platforms.

Can I be compliant if I use AWS, Azure, or GCP?

Yes—but cloud providers are only responsible for the infrastructure, not how you configure or use it. You’re still on the hook for:

– Securing access keys

– Configuring proper encryption

– Managing logging and monitoring

– Cloud compliance is a shared responsibility—make sure your dev team understands their part.

Conclusion: Build Fast, Stay Compliant, Scale Confidently

Security and compliance don’t have to be blockers for growth—they can be your launchpad.

By embracing DevSecOps, using smart automation tools, and working with the right development partner, you can go to market fast without compromising trust, safety, or regulatory alignment.

At JoomDev, we’ve helped fintech startups:

- Launch MVPs in 8–12 weeks

- Pass SOC 2 Type I and II audits

- Design PCI DSS-aligned payment platforms

- Implement secure infrastructure that scales

Need help with your fintech compliance journey?

Reach out today for a free 30-minute consultation.

We’ll help you map your security strategy, choose the right tools, and build an infrastructure auditors—and users—will trust.