In an era where digital innovation is reshaping industries, financial technology (fintech) has emerged as a transformative force.

Fintech apps have revolutionized the way people manage their finances, offering convenience, security, and accessibility like never before. From digital wallets and investment platforms to mobile banking and peer-to-peer lending, fintech applications are not just tools—they are the backbone of modern financial ecosystems.

As businesses and consumers alike continue to embrace this digital-first approach, the demand for cutting-edge fintech app development is at an all-time high.

In this comprehensive guide, we delve into the essentials of fintech app development, exploring key features, cost considerations, monetization strategies, and everything you need to build a successful fintech app that stands out in today’s competitive market.

Whether you’re a fintech startup or an established financial institution, this fintech app development guide will equip you with the insights to make informed decisions and create value-driven solutions for your audience

Key Highlights

- The fintech industry is booming, with significant investments and consumer adoption driving demand for innovative financial apps.

- Successful fintech apps prioritize user-friendly features like account management, secure payment gateways, and real-time notifications.

- Advanced technologies like AI, blockchain, and biometric authentication enhance functionality and security.

- Developing a fintech app requires a structured approach, including ideation, selecting the right tech stack, designing a seamless UI/UX, backend and frontend development, and rigorous testing before deployment.

- Fintech app development costs vary based on complexity, platform, and features, ranging from $20,000 for basic apps to $150,000+ for advanced solutions.

- Starting with an MVP and choosing the right development partner can optimize costs.

- Common revenue strategies include subscriptions, transactional fees, advertising, and API monetization.

- A reliable fintech app development company should offer expertise in compliance, security, and innovative technologies.

- Emerging trends like open banking, AI-driven insights, and voice technology are shaping the fintech landscape.

The Rise of Fintech Apps – A Data-Driven Perspective

The fintech industry has experienced remarkable growth in recent years, reshaping the financial landscape and consumer behaviors worldwide. Key statistics highlighting this expansion include:

- Global Market Valuation: The fintech market is projected to grow from $356.73 billion in 2025 to $686.85 billion by 2030, exhibiting a compound annual growth rate (CAGR) of over 14%. ~ Mordor Intelligence

- Consumer Adoption: As of 2023, the global adoption rate of fintech products reached 64%, with 96% of consumers aware of at least one payment fintech firm. ~Exploding Topics

- Digital Payments Growth: The digital payments segment is expected to grow at a CAGR of 19.4% from 2021 to 2028, driven by increasing adoption of digital payment methods and the rise of e-commerce. ~Mandalasystem Blog

- Regional Leadership: The United States and China dominate the fintech landscape, with seven of the world’s top ten largest fintech companies based in these two nations. ~ Growth List

These statistics shows the rapid expansion and significant impact of fintech applications globally.

As consumer demand for digital financial solutions continues to rise, the fintech sector is poised for sustained growth, offering ample opportunities for innovation and investment.

So now the question is that If I’m planning to develop a fintech app for my business, what key features should I consider including?

Key Features of Fintech Apps

Fintech apps are transforming the way individuals and businesses interact with financial services.

To stand out in the competitive market, your fintech application must offer innovative features that enhance user experience, ensure security, and provide value.

Here’s a breakdown of the key features that define successful fintech applications:

- User-Centric Features

- Security and Compliance

- Integration and Automation

- Financial Tools

- Advanced Technologies

User-Centric Features

Effortless Account Management:

Allow users to manage multiple accounts, track transactions, and set financial goals with a few taps.

Real-Time Notifications:

Provide instant alerts for transactions, account updates, or personalized financial advice.

AI-Powered Insights:

Leverage artificial intelligence to analyze spending habits and offer tailored savings and investment recommendations.

Multi-Currency Support:

Enable seamless transactions in multiple currencies, especially for businesses and international users.

Personalized Dashboards:

Interactive dashboards that visualize spending patterns, budgets, and account balances in a user-friendly format.

Security and Compliance

Biometric Authentication:

Use fingerprint, face recognition, or voice ID for enhanced security.

Two-Factor Authentication (2FA):

Add an extra layer of protection by combining passwords with OTPs or authentication apps.

Data Encryption:

Ensure all user data is encrypted during storage and transmission to prevent unauthorized access.

Regulatory Compliance:

Align with regional and international regulations like GDPR, PCI DSS, and PSD2 for secure financial operations.

Integration and Automation

Third-Party API Integration:

Collaborate with services like payment gateways, tax calculators, or blockchain platforms for added functionality.

Automated Workflows:

Automate recurring tasks like bill payments, salary disbursements, or portfolio rebalancing.

Financial Tools

Payment Gateway Integration:

Allow secure payments via credit cards, UPI, mobile wallets, and QR codes.

Investment Management Tools:

Help users manage their portfolios, track market trends, and automate investments through robo-advisors.

Budgeting Tools:

Provide tools to track expenses, set limits, and categorize spending for better financial control.

Advanced Technologies

Blockchain Integration:

Secure transactions with decentralized ledger technology, ensuring transparency and reducing fraud.

Chatbots and Virtual Assistants:

AI-driven assistants that help users with queries, transactions, and financial advice 24/7.

Voice and Speech Recognition:

Simplify interactions with voice commands for account checks or fund transfers.

Integrating these features ensures that your fintech app not only meets market standards but also provides a unique, user-friendly experience.

As competition grows, these key functionalities are essential to securing your app’s place in the evolving fintech landscape.

How to Monetize Your Fintech App: Revenue Models That Work

While developing your fintech app, it’s crucial to have a clear plan for how you intend to monetize it. Choosing the right monetization model is crucial to ensure a steady revenue stream and long-term sustainability.

Here are some of the most effective monetization strategies used by successful fintech apps:

Subscription Model

How It Works:

Users pay a recurring fee (monthly, yearly) to access premium features or services. Most apps offer a free trial to attract users before converting them to paid plans.

Examples:

- Personal Finance Apps like YNAB (You Need a Budget) charge a monthly subscription for advanced budgeting tools.

- Investment Platforms like Betterment offer tiered subscription plans based on the level of service.

Benefits:

- Predictable and recurring revenue.

- Encourages long-term user engagement.

Transactional Fees

How It Works:

Charge users a small percentage or flat fee for processing transactions, transfers, or payments.

Examples:

- Payment Gateways like Stripe and PayPal charge merchants for each transaction.

- Remittance Apps like Wise (formerly TransferWise) charge low fees for international money transfers.

Benefits:

- High profitability for apps with large transaction volumes.

- Appeals to users with competitive pricing.

Freemium Model with In-App Purchases

How It Works:

Offer basic services for free while charging for advanced features or add-ons.

Examples:

- Budgeting Apps like Mint provide free tools but charge for services like credit score monitoring.

Benefits:

- Attracts a large user base with free features.

- Converts active users to paying customers over time.

Advertising and Referrals

How It Works:

Generate revenue by displaying targeted ads or promoting partner services in exchange for referral fees.

Examples:

- Personal Finance Apps like Credit Karma earn revenue by recommending credit cards and loans.

Benefits:

- Monetizes free users effectively.

- Builds additional revenue streams with minimal user friction.

API Monetization

How It Works:

Offer APIs to third-party developers or businesses, enabling them to integrate your services into their applications. Charge based on usage or a subscription.

Examples:

- Stripe’s API powers payment processing for countless businesses worldwide.

Benefits:

- Establishes your app as a core service provider in the fintech ecosystem.

- Opens new revenue channels from enterprise clients.

Data Monetization

How It Works:

Provide anonymized user data to businesses or researchers for analytics and AI training.

Examples:

- Mint uses this model to sell data insights to financial institutions.

Benefits:

- Leverages existing data to generate additional revenue.

- Drives strategic partnerships with other businesses.

Partnerships and White-Label Solutions

How It Works:

Partner with banks or financial institutions to provide customized solutions under their branding.

Examples:

- White-label payment solutions like Payoneer enable businesses to integrate branded financial services.

Benefits:

- Expands your market reach.

- Provides a steady stream of enterprise-level revenue.

Selecting the best monetization model depends on your app’s target audience, features, and market positioning.

For startups, starting with a simple freemium model or transactional fees can help establish a user base.

As the app scales, introducing additional revenue channels like subscriptions or partnerships ensures diversified income.

Pro Tip: Conduct user research and analyze competitors to align your monetization model with user preferences and industry trends.

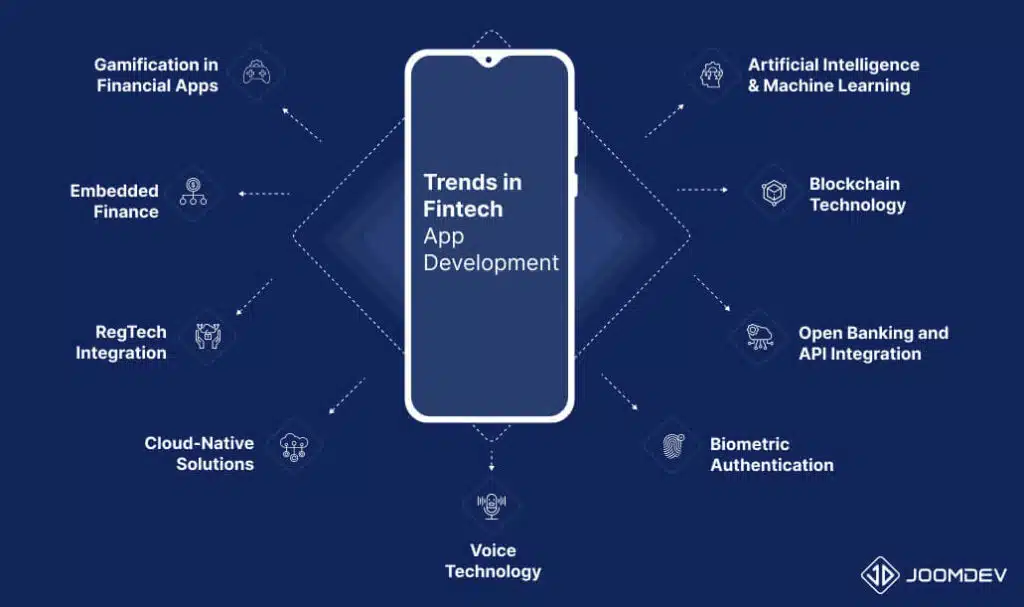

Trends in Fintech App Development

The fintech industry is evolving rapidly, driven by technological advancements and changing consumer expectations. To stay competitive, businesses must adopt latest trends that redefine how financial services are delivered.

Here are the key trends shaping the future of fintech app development:

Artificial Intelligence and Machine Learning

Impact:

AI-powered solutions enhance user experiences by providing personalized financial insights, fraud detection, and automated customer support.

Machine learning algorithms analyze user data to recommend tailored financial products and services.

Examples:

- Chatbots like Cleo offer real-time financial advice and transaction tracking.

- Fraud detection systems use AI to identify suspicious activities instantly.

Blockchain Technology

Impact:

Blockchain ensures secure, transparent, and tamper-proof transactions. It’s widely used for cryptocurrency trading, smart contracts, and decentralized finance (DeFi) applications.

Examples:

- Apps like Coinbase facilitate secure crypto transactions.

- Smart contracts are used in lending and insurance apps for automated claims processing.

Open Banking and API Integration

Impact:

Open banking enables third-party developers to build applications and services around financial institutions, offering users a more comprehensive and connected financial experience.

Examples:

- Open banking APIs allow apps to aggregate account information and facilitate seamless transactions.

- Apps like Plaid integrate with multiple banks to offer unified account management.

Biometric Authentication

Impact:

Biometric technologies, such as fingerprint scanning, facial recognition, and voice ID, enhance security and streamline user authentication processes.

So when you are going for fintech app development, make sure you are using biometric Authentication in your fintech application. It not only enhance the security, but also increase the user experience.

Examples:

- Apple Pay and Google Pay use biometric authentication for secure payments.

- Banking apps implement voice recognition for account access.

Voice Technology

Impact:

Voice recognition and AI assistants enable users to perform tasks like checking account balances, making payments, or receiving financial advice through voice commands.

Examples:

- Alexa and Google Assistant integrate with banking apps to perform transactions via voice.

Cloud-Native Solutions

Impact:

Cloud-based infrastructure enhances scalability, reduces operational costs, and improves your fintech app performance. It allows fintech companies to process large volumes of data efficiently.

Examples:

- Apps like Revolut leverage cloud computing for seamless global financial operations.

RegTech Integration

Impact:

Regulatory technology (RegTech) automates compliance with financial regulations, ensuring fintech apps meet legal and security standards.

Examples:

- Apps integrate RegTech to monitor and report compliance with GDPR, PCI DSS, and PSD2.

Embedded Finance

Impact:

Embedded finance integrates financial services like payments, lending, and insurance directly into non-financial platforms, offering a seamless user experience in your fintech application.

Examples:

- Ride-sharing apps like Uber provide in-app payment options.

Gamification in Financial Apps

Impact:

Gamification engages users by introducing elements like rewards, challenges, and progress tracking in financial activities.

It will not only increase the in-app time but also encourgage users to make transactions.

Examples:

- Apps like Acorns gamify saving and investing by rounding up transactions and investing spare change.

Keeping pace with these trends is essential for businesses to create fintech apps that are not only innovative but also aligned with evolving user needs.

By incorporating technologies like AI, blockchain, and open banking, you can deliver a seamless, secure, and personalized financial experience that sets your app apart.

How to Choose the Best Fintech App Development Company

Selecting the right fintech app development company is a critical step in building a successful financial application. After all, this is the partner who will bring your vision to life and help you stand out in a competitive market.

The decision isn’t just about coding expertise—it’s about finding someone who understands the complexities of fintech, from compliance to user experience.

Here’s how to identify the best fintech app development company for your project:

Evaluate Their Experience in Fintech

When it comes to fintech, experience truly matters.

Think about it: would you trust someone to manage your finances if they’ve never handled money before?

It’s the same with fintech app development.

A company with a proven track record in building successful fintech apps knows the unique challenges of this industry, like integrating with banking APIs, ensuring top-notch security, and navigating compliance requirements.

You’ll want a partner who has done this before and can bring their expertise to your project.

What to Look For:

- Proven track record in developing fintech applications like digital wallets, payment gateways, or investment platforms.

- Case studies showcasing successful fintech projects.

- Testimonials from clients in the financial sector.

Assess Their Technical Expertise

Fintech apps are not your typical mobile applications—they require advanced technologies to provide seamless and secure services.

Imagine you’re building a digital wallet or a payment gateway.

The technology needs to handle real-time transactions, large-scale data processing, and robust security.

A team with expertise in tools like blockchain, AI, and API development can ensure your app performs flawlessly.

The right partner will have the technical skills to turn your innovative ideas into a high-performing reality.

What to Look For:

- Proficiency in programming languages like Python, Java, and Kotlin etc.

- Knowledge of frameworks like React Native, Flutter, and Node.js.

- Expertise in integrating APIs and payment gateways.

Prioritize Security and Compliance Knowledge

Security and compliance are the backbone of any fintech app.

Picture this: your app handles sensitive user data like bank account details and personal information. One small mistake, and you could lose user trust—or worse, face legal penalties.

A strong development partner won’t just understand encryption and biometric authentication; they’ll also be well-versed in regulations like GDPR, PCI DSS, and PSD2.

They’ll help you build a secure fintech app that users can trust and regulators can approve.

What to Look For:

- Experience with implementing two-factor authentication and encryption.

- Knowledge of global compliance standards like GDPR, PCI DSS, PSD2, and Open Banking.

- Tools and techniques for conducting regular security audits.

Explore Their Design Capabilities

Have you ever downloaded an app that looked amazing but was frustrating to use?

Fintech apps need to strike the perfect balance between functionality and aesthetics.

A well-designed app makes complex financial operations simple for users, keeping them engaged and satisfied.

The right development company will know how to create a user interface (UI) that’s intuitive and visually appealing while ensuring the user experience (UX) is seamless.

After all, a great design can be the difference between a one-time user and a loyal customer.

What to Look For:

- A portfolio of fintech apps with clean, intuitive designs.

- Expertise in creating user-friendly interfaces for complex workflows.

- Cross-platform design capabilities for iOS, Android, and web apps.

Understand Their Development Process

Building a fintech app is not a one-time task—it’s a journey. You need a development partner who’s not only technically skilled but also transparent and collaborative.

Imagine working with a team that keeps you in the dark or doesn’t involve you in key decisions.

That’s a recipe for frustration.

A company with a clear and flexible process, like Agile development, will keep you updated, adapt to your feedback, and ensure your vision is translated perfectly into the final product.

What to Look For:

- Use of Agile methodologies for flexibility and faster iterations.

- Detailed project timelines and communication schedules.

- A dedicated project manager or point of contact.

Check Client Reviews and References

Would you hire someone without knowing how they’ve performed in the past?

Client reviews and references are like a window into a company’s reliability and professionalism. They tell you if the team delivers on time, communicates well, and produces quality work.

It’s like reading reviews before buying a product—you’ll feel much more confident knowing others had a great experience with the company you’re considering.

What to Look For:

- Reviews on platforms like Clutch, GoodFirms, or Google.

- Testimonials from previous fintech clients.

- Direct references you can contact to verify their work.

Post-Launch Support and Scalability

Launching your app is just the beginning.

Think about how quickly technology evolves and how user needs change.

A reliable development partner will be there to support you post-launch, fixing bugs, rolling out updates, and adding new features as your business grows.

Plus, if your app gains more users than expected (a great problem to have!), you’ll need it to scale without hiccups.

A good partner plans for scalability right from the start, ensuring your app grows as your business does.

What to Look For:

- Clear post-launch support policies, including bug fixes and updates.

- Scalability planning during the initial development stages.

- Experience with cloud-based solutions for seamless scaling.

Choosing the right fintech app development company is about more than just technical skills.

It’s about finding a partner who understands your vision, shares your passion for innovation, and has the expertise to deliver a secure, scalable, and user-friendly app.

By considering these factors and knowing what to look for, you can confidently take the next step in bringing your fintech app to life.

Cost of Fintech App Development: Understanding the Investment

One of the most important questions when planning your fintech app is, “How much will it cost?”

The truth is, there’s no one-size-fits-all answer.

The cost of fintech app development varies depending on several factors, including the complexity of features, the platform you choose, and the expertise of your development team.

Let’s break down these factors to help you understand the investment required.

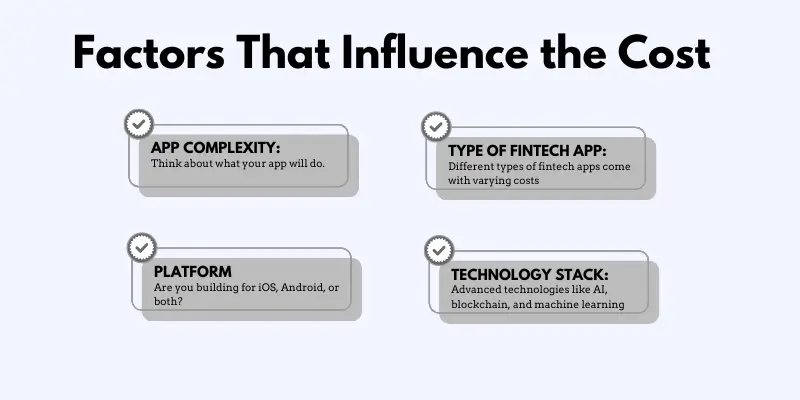

Factors That Influence the Cost

App Complexity:

Think about what your app will do.

A basic app with minimal features like account management might cost between $20,000 and $50,000. If you’re aiming for advanced functionalities like AI-driven insights, blockchain integration, or real-time analytics, expect costs to exceed $150,000.

Type of Fintech App:

Different types of fintech apps come with varying costs:

- Digital wallets: Apps like PayPal or Venmo require robust security and multi-currency support.

- Investment platforms: Tools like Robinhood demand advanced analytics and compliance integration.

- Lending apps: Peer-to-peer lending apps need secure transaction systems.

Each category has unique development requirements that impact cost.

Platform:

Are you building for iOS, Android, or both? A cross-platform app can save costs but may compromise on native experience.

Meanwhile, building separate apps for each platform can increase expenses but provide optimized performance.

Technology Stack:

Advanced technologies like AI, blockchain, and machine learning are essential for modern fintech apps.

These add value but also increase the cost. Similarly, integrating third-party APIs for payment gateways, bank integrations, or financial analytics will affect the budget.

Cost Estimates for Fintech App Development

- Basic App: $20,000–$50,000

Ideal for startups or MVPs with core features like user registration, account management, and simple payment integration. - Moderate App: $50,000–$150,000

Includes additional features like multi-currency support, advanced security measures, and enhanced UI/UX. - Advanced App: $150,000+

Suitable for apps with cutting-edge technologies like blockchain, AI, predictive analytics, and extensive third-party integrations.

How to Reduce Development Costs

Start with an MVP:

Building a Minimum Viable Product (MVP) lets you launch faster with core features while saving on initial costs. Additional features can be added based on user feedback.

Use Open-Source Solutions:

Open-source libraries and tools can reduce development time and costs without compromising quality.

Partner with the Right Development Company:

Experienced fintech app developers can help you choose cost-effective technologies and avoid common pitfalls, saving money in the long run.

Outsource Smartly:

Consider outsourcing to regions with skilled developers but lower costs, such as Eastern Europe or South Asia. Ensure the team has fintech expertise to maintain quality.

Hidden Costs to Consider

- Compliance and Licensing:

Fintech apps must adhere to regulations like GDPR, PCI DSS, and PSD2. Ensuring compliance often incurs additional expenses. - Maintenance and Updates:

Post-launch support, bug fixes, and feature updates can cost anywhere from $2,000 to $10,000 per month, depending on the app’s complexity. - Scalability Costs:

As your user base grows, you may need to invest in cloud infrastructure or server upgrades to handle increased demand.

The cost of developing a fintech app depends on your vision and the features you want to include.

While the investment may seem significant, remember that a well-built app can open up new revenue streams and position your business as a leader in the financial technology space.

Partnering with the right fintech app development company is key to balancing cost and quality, ensuring your app delivers long-term value.

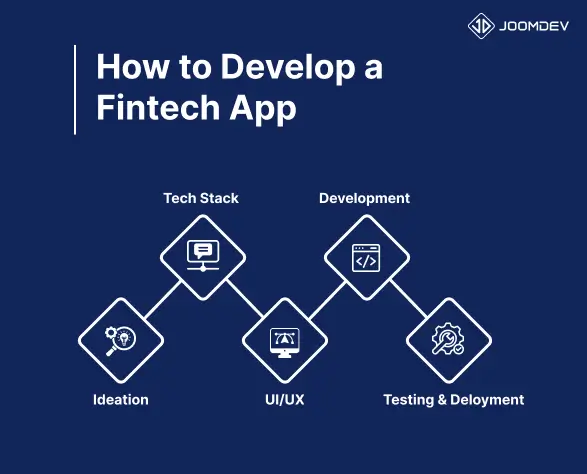

How to Develop a Fintech App

Developing a fintech app is a multi-step journey that combines strategic planning, innovative technology, and meticulous execution.

To ensure your app meets market demands and user expectations, it’s crucial to follow a structured process.

Here’s a step-by-step guide to building a successful fintech app:

Step 1: Ideation and Market Research

A strong foundation starts with understanding your target audience, their pain points, and existing market gaps. Market research helps you define your app’s unique value proposition and competitive edge. If you are starting working on your Fintech App Idea, you should check this Creating an App Idea guide.

What to Do:

- Identify your target audience and their needs (e.g., individuals, businesses, or specific niches like cryptocurrency or peer-to-peer lending).

- Analyze competitors to determine what works and where they fall short.

- Define your app’s core features based on user demands and market trends.

Step 2: Choosing the Right Tech Stack and Platform

The technology stack and platform you choose will determine your app’s performance, scalability, and development cost. Selecting the right tools ensures your app can handle future demands and provide a seamless experience.

What to Do:

- Decide on the platform: iOS, Android, or cross-platform solutions like Flutter or React Native.

- Choose a backend stack: Options like Node.js, Python, or Java are popular for fintech apps.

- Integrate APIs for payments, data security, or third-party services (e.g., Plaid, Stripe).

Step 3: Designing User-Friendly UI/UX

The design of your app plays a pivotal role in user retention. A user-friendly interface with intuitive navigation ensures a positive experience, encouraging users to engage with your app frequently.

What to Do:

- Create wireframes and prototypes to visualize the user journey.

- Prioritize simplicity and clarity in design while ensuring it aligns with your brand identity.

- Test the design with a small user group to gather feedback before moving to development.

Step 4: Developing the Backend and Frontend

The backend is the engine of your app, handling data processing, security, and integrations, while the frontend is what users interact with. Together, they create a seamless experience.

What to Do:

- Develop a secure backend with robust authentication, encryption, and database management.

- Build a responsive frontend using frameworks like Angular, React, or Vue.js.

- Integrate key features like payment processing, data analytics, and notifications.

Step 5: Testing and Deployment

Rigorous testing ensures your app is free from bugs, secure, and user-friendly. A smooth deployment process guarantees a strong start for your app in the market.

What to Do:

- Conduct functional testing to ensure all features work as intended.

- Perform security testing to identify vulnerabilities.

- Test the app across multiple devices and platforms for compatibility.

- Deploy the app on the chosen platform(s) and monitor user feedback for improvements.

Developing a fintech app is a step-by-step process that requires strategic planning, cutting-edge technology, and an experienced development team.

From understanding market demands to deploying a secure and user-friendly product, each phase is critical to the app’s success.

By following this structured approach and partnering with the right fintech app developers, you can create a fintech app that meets user needs and achieves business goals.

Frequently Asked Questions

What is a fintech app?

A fintech app is a mobile or web application designed to provide financial services like banking, payments, lending, investment management, and budgeting. These apps use advanced technologies like AI, blockchain, and biometrics to enhance user experience, improve security, and streamline financial processes.

How much does it cost to develop a fintech app?

The cost of developing a fintech app varies based on its complexity and features:

– Basic apps: $20,000–$50,000

– Moderate apps: $50,000–$150,000

– Advanced apps: $150,000+

Factors like the platform (iOS, Android, or cross-platform), technology stack, and integrations also impact the cost.

How long does it take to develop a fintech app?

The development timeline depends on the app’s complexity:

– Basic apps: 3–6 months

– Moderate apps: 6–9 months

– Advanced apps: 9–15 months

Additional time may be required for testing, compliance checks, and post-launch improvements.

What are the key features of a fintech app?

Essential features of a fintech app include:

– Account management

– Secure payment gateways

– Real-time notifications

– AI-powered financial insights

– Multi-currency support

– Advanced security measures like biometric authentication

What are the most common monetization models for fintech apps?

A typical app with basic features can cost between $10000 to $40000.

How much does it cost to develop an app with advanced features?

Fintech apps can be monetized through:

– Subscriptions: Charging users a recurring fee for premium features.

– Transactional fees: Charging a percentage or flat fee for transactions.

– Advertising and referrals: Partnering with advertisers or financial institutions.

– API monetization: Offering API access to third-party developers for a fee.

What technologies are commonly used in fintech app development?

Popular technologies for fintech apps include:

– Programming languages: Python, Java, Kotlin, Swift.

– Frameworks: React Native, Flutter, Node.js.

– Integrations: Blockchain, AI, APIs for payments and banking services.

– Databases: PostgreSQL, MongoDB, and cloud-based solutions for scalability.

Wrapping Up

The fintech revolution has fundamentally reshaped the way we interact with financial services, offering businesses and consumers unparalleled convenience, security, and efficiency.

Developing a fintech app is not just about coding—it’s about understanding market needs, leveraging cutting-edge technologies, and creating user-centric solutions that drive value.

In this guide, we’ve explored every aspect of fintech app development, from key features and monetization strategies to the step-by-step process of bringing your app to life.

Whether you’re planning a simple digital wallet or a complex investment platform, the journey requires careful planning, technical expertise, and a commitment to delivering a seamless user experience.

At JoomDev, we specialize in crafting innovative, secure, and scalable fintech solutions tailored to your unique business needs.

Our team of experienced developers, designers, and fintech experts is ready to turn your vision into reality.

With a proven track record in fintech app development, we ensure that your app is not only technically flawless but also aligned with market trends and user expectations.

Ready to Build Your Fintech App?

Let’s work together to create a solution that redefines financial services.

Whether you’re a startup looking to break into the market or an established business aiming to expand, we’re here to help you succeed